A combination of low price-to-earnings valuation and high expected growth rates can set up good performance over the long term

These companies are four of the top holdings of the Gabelli Financial Services Opportunities exchange-traded fund.

The Gabelli Financial Services Opportunities Fund is an exchange-traded fund that is actively managed. This fund is less than two years old but has performed very well. A list of its holdings and estimates for the fund’s portfolio illustrate why the approach has worked well so far.

A changing market for ETFs

Most exchange-traded funds are passively managed, which means they track broad indexes, such as the S&P 500 SPX, or they track a market sector or industry groups by basing their portfolios on custom-designed indexes. But actively managed ETFs have advantages over traditional open-ended mutual funds — and they are becoming more popular.

Actively managed ETFs represent about 5% of total assets under management for the ETF industry but took in nearly 22% of ETF inflows during 2023, according to Morningstar.

One advantage of ETFs is that you can easily trade in or out of them when the stock market is open. Open-ended mutual funds, on the other hand, are priced once a day when the market closes, and that is when you can buy or sell shares.

ETFs may also have tax advantages, depending on how you invest.

Open-ended mutual funds distribute capital gains to shareholders, and this can have painful tax consequences, unless the fund shares are held within a tax-deferred account, such as a 401(k) or an IRA.

If you buy shares of a mutual fund outside of a retirement account, and then a month later the fund manager decides to change strategy and sell several holdings and book capital gains, your portion of the capital gains — even on positions held for many years before you bought your fund shares — will be distributed to you. Let’s say you paid $10 a share for your fund shares, and then the fund paid out a capital gain of a dollar a share a month later. All things being equal, the share price would decline by that dollar, you would get the dollar in cash and that would be taxed. You would gain nothing but taxes under that scenario.

But with an ETF, different accounting rules and tax treatment make capital-gains distributions less likely. Fidelity explains the differences in tax treatment for ETFs and mutual funds here.

A financial-services ETF that has outperformed

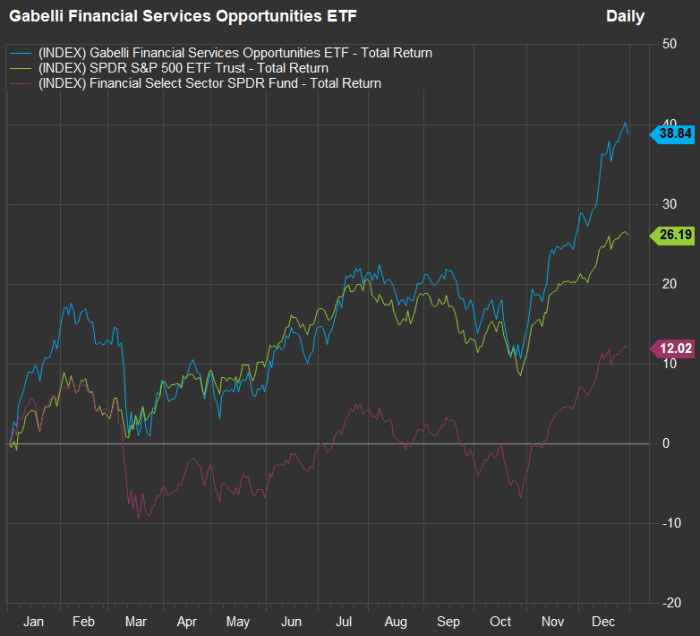

The Gabelli Financial Services Opportunities Fund ETF GABF was launched on May 9, 2022. Since then, it has returned 36%, compared with 21% for the S&P 500 and 17% for the S&P 500 financial sector.

This chart shows how the fund performed during 2023 against the SPDR S&P 500 ETF Trust SPY and the Financial Select Sector SPDR ETF XLF, which tracks the S&P 500 financial sector by holding all of its stocks and weighting them by market capitalization:

Stocks — especially in the financial sector — shot up late last year as long-term interest rates fell. FACTSET

The total returns in the chart include the reinvestment of dividends and are after expenses, which in the case of GABF are waived at least until the fund reaches $50 million in assets under management, Sykes said. The fund now has about $10 million in assets. Its full expenses would be 0.90% of assets under management.

All three funds had fallen to their second-half closing lows on Oct. 27, when the yield on 10-year U.S. Treasury notes BX:TMUBMUSD10Y was 4.84%. By the end of the year, the 10-year yield had fallen to 3.88%.

During an interview with MarketWatch, Macrae Sykes, who manages the Gabelli Financial Services Opportunities Fund, discussed how the Federal Reserve’s rapid increase in the federal-funds rate in 2022 and 2023 had caused banks’ net interest margins to narrow. A bank’s net interest margin, or NIM, is the difference between the average yield it earns on loans and investments and its average cost for deposits and borrowings.

Sykes said that in general, higher interest rates should be good for banks. But during this rate cycle, short-term interest rates and the cost for deposits shot up quickly, while the yield curve inverted. The Federal Reserve has the federal-funds rate in a target range of 5.25% to 5.50%, which is considerably higher than the yield on the 10-year Treasury, which was 3.95% early Thursday. You can easily get a 12-month certificate of deposit right now with a yield of 5.5%.

But Sykes said that during fourth-quarter industry conferences, bankers were saying they expected NIM to trough during the first half of 2024 and then widen through 2025.

“That is a good setup. As we go through 2024, we will start to see earnings tailwinds associated with rising net interest income,” he said.

Growth estimates

Sykes’s strategy for the Gabelli Financial Services Opportunities Fund is to take advantage of growing demand for advisory and asset-management services as wealth is transferred from the baby boomer generation to younger generations.

Within the GABF portfolio, he holds about 40 stocks of companies with what he considers to be “strong fundamentals,” along with profit-growth expectations that are higher than those of the broad market and the financial sector. He also “takes a look at the competition” for all companies held by the fund.

Here’s a comparison of the Gabelli Financial Services Opportunities Fund, the SPDR S&P 500 ETF Trust and the Financial Select Sector SPDR ETF, to show forward price-to-earnings valuations and expected compound annual growth rates for earnings per share, based on consensus calendar-year earnings-per-share estimates among analysts polled by FactSet.

| ETF | Price/ consensus 2024 EPS estimate | Expected two-year EPS CAGR through 2025 | Est. 2023 EPS | Est. 2024 EPS | Est. 2025 EPS | Jan. 3 price |

| Gabelli Financial Services Opportunities ETF | 13.5 | 15.2% | $2.08 | $2.38 | $2.76 | $32.14 |

| SPDR S&P 500 ETF Trust | 19.2 | 12.0% | $21.87 | $24.38 | $27.41 | $468.79 |

| Financial Select Sector SPDR Fund | 14.6 | 9.2% | $2.39 | $2.57 | $2.85 | $37.44 |

| Source: FactSet | ||||||

The Gabelli Financial Services Opportunities ETF trades at a lower P/E valuation and is expected to show a considerably higher annualized growth rate for EPS over the next two years.

Here’s a look at P/E and expected EPS CAGR for the fund’s top 10 holdings:

| Company | Ticker | % of GABF portfolio | Price/ consensus 2024 EPS estimate | Expected two-year EPS CAGR through 2025 |

| Berkshire Hathaway Inc. Class B | BRK.B, +0.71% | 7.0% | 20.7 | 4.0% |

| FTAI Aviation Ltd. | FTAI, +2.87% | 6.9% | 21.1 | 46.3% |

| Blue Owl Capital Inc. Class A | OWL, +1.70% | 4.9% | 19.4 | 20.8% |

| Blackstone Inc. | BX, +0.11% | 4.4% | 23.1 | 26.9% |

| Apollo Global Management Inc. | APO, +1.43% | 4.4% | 11.6 | 18.4% |

| American Express Co. | AXP, +0.08% | 4.3% | 15.1 | 12.2% |

| First Citizens BancShares Inc. Class A | FCNCA, +2.58% | 4.1% | 7.4 | 5.8% |

| Interactive Brokers Group Inc. Class A | IBKR, -0.31% | 4.0% | 13.7 | 3.3% |

| W.R. Berkley Corp. | WRB, -2.35% | 4.0% | 12.5 | 15.9% |

| Wells Fargo & Co. | WFC, | 3.8% | 9.9 | 5.1% |

| Source: FactSet | ||||

Click on the tickers for more about each company.

‘A mini Berkshire Hathaway’

One company Sykes highlighted during the interview was W.R. Berkley Corp. WRB, -2.35%, which he called a “mini Berkshire Hathaway” BRK.B, +0.71%, making reference to the fund’s largest holding.

W.R. Berkley provides property and casualty insurance, including car insurance, as well as reinsurance. Sykes said the stock’s combination of a low P/E and high expected earnings growth rate was particularly attractive.

With such a high EPS growth rate, W.R. Berkley’s stock may continue to perform well over the long term, even if its P/E valuation doesn’t expand. Sykes agreed, saying he wouldn’t want to see the valuation expand very much because “they are buying back shares at this multiple.” Stock buybacks can lower a company’s share count and increase its EPS.

He pointed to page 11 of W.R. Berkley’s 2022 annual report, which showed an average annual return for the stock (with dividends reinvested) of 23.7%, compared with 12.4% for the S&P 500. The company was founded by William R. Berkley in 1967. He serves as executive chair, and his son, W. Robert Berkley, Jr., serves as CEO.

Sykes said the P&C insurance industry is in a “hard market for allocating capital and writing premiums,” but he also said he expected the turnover in W.R. Berkley’s investment portfolio to continue to affect its earnings positively. Insurers invest premiums with the aim of earning profits before paying out to cover losses. “Their book yield on their investments was 4.5% during the third quarter. They are reinvesting at 6%,” he said.

Sykes went on to emphasize that the Gabelli Financial Services Opportunities Fund is diversified, despite being focused on the financial sector. A company such as JPMorgan Chase & Co. JPM, -0.15%, which is held in the portfolio, has multiple lines of business, including asset management, wealth management, securities custody and payments, in addition to its investment-banking and lending businesses, he said.

When discussing JPMorgan and Morgan Stanley MS, +0.29%, another holding of the fund, he said both companies had suffered in 2023 from “the weakest year for initial public offerings since 2016.”

But with JPMorgan “well reserved, with improving NIM … and the potential capital markets increase, including M&A,” Sykes said he sees a “nicer setup” for both banks.

Published: January 4, 2024

Author: PHILIP VAN DOORN

Article originally posted at https://www.marketwatch.com/story/actively-managed-etfs-are-growing-in-popularity-heres-what-you-want-one-to-look-like-fb8c39c1