The semitransparent active ETFs structure is already three years old. Several products that launched in late 2020 are nearing or passed their third birthdays.

In investing, three years is a key milestone. Many investors wait to invest in actively managed strategies until they have a track record of at least three years. This is to gain better insight into performance and how the fund will be managed across multiple market environments.

The three-year mark is also important regarding getting an ETF on broker-dealer platforms. While UBS, Merrill Lynch, and Morgan Stanley Wealth Management added a small number of strategies that look to “shield holdings” to their platforms last year, widespread adoption could grow, with many funds in the category hitting their three-year anniversaries.

“Three years is an important landmark for many big asset managers,” said Lara Crigger, editor-in-chief of VettaFi. “Many institutions and large hedge funds won’t — or can’t — consider an ETF with a shorter track record than that.”

Semitransparent Active ETFs Have Shown Strong Outperformance

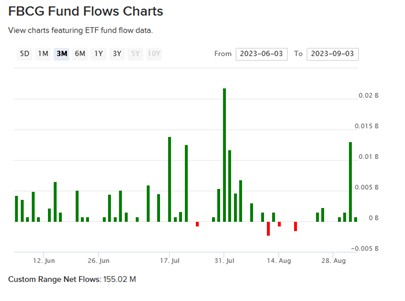

Several semitransparent active ETFs have shown strong performance over their three-year track records. For example, the Fidelity Blue Chip Growth ETF (FBCG) crossed its three-year mark in June; in the three months after that birthday, its AUM jumped to over $155 million, per VettaFi’s ETF Database.

Fund flows for the Fidelity ETF FBCG.

Source: ETF Database, FactSet. Data from June 3, 2023 to September 3, 2023.

FBCG looks for stocks that have been “mispriced” by the market. It focuses on large-cap companies with above-average earnings growth potential and sustainable business models.

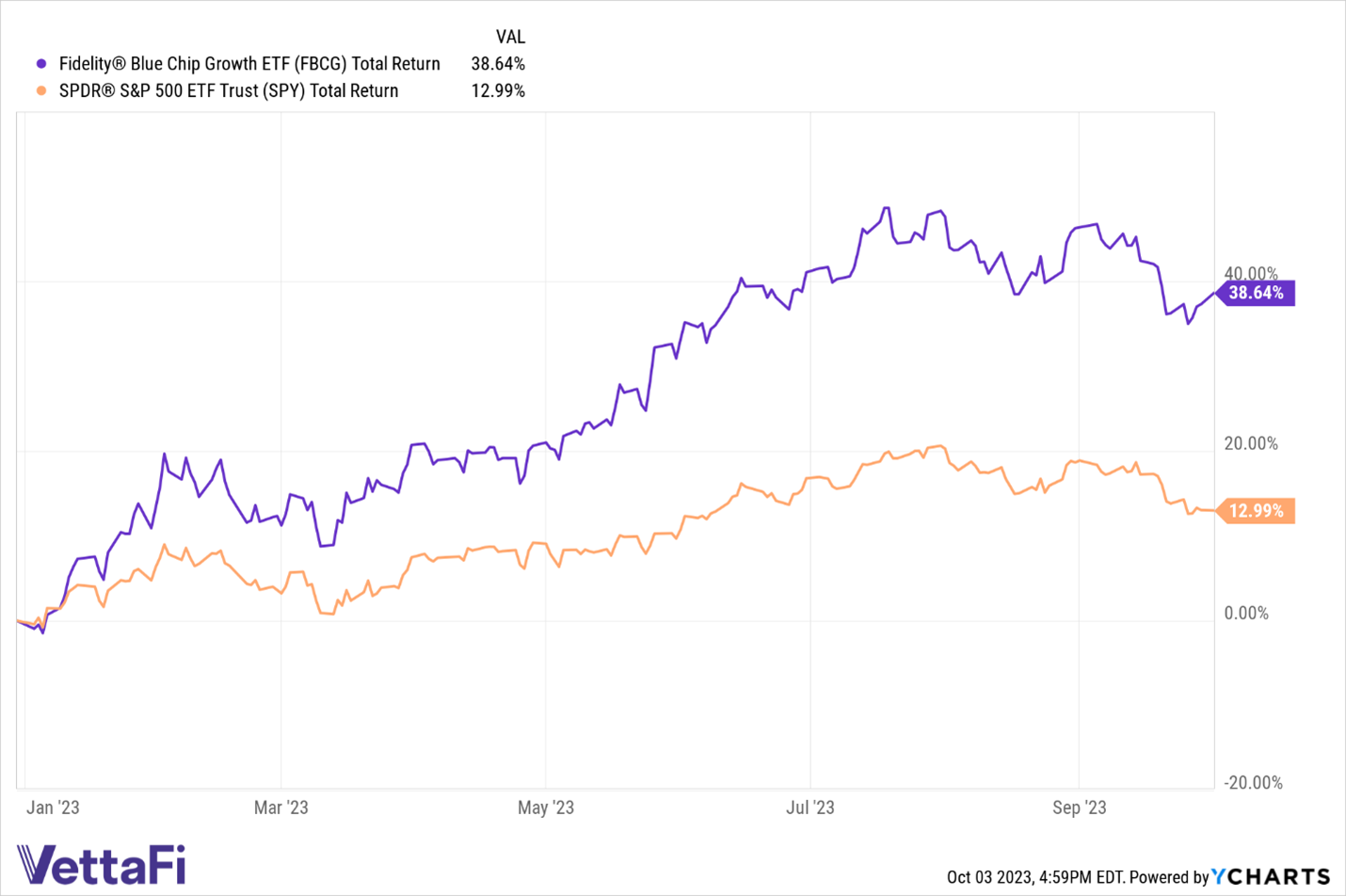

As of October 3, FBCG has outperformed the SPDR S&P 500 ETF Trust (SPY) and the iShares S&P 500 Growth ETF (IVW) by 23% and 18%, respectively, year to date per YCharts.

FBCG has outperformed SPY per YCharts on a YTD basis as of October 3.

Other Fidelity strategies are also nearing that key three-year milestone. For example, the Fidelity Magellan ETF (FMAG), which offers the same strategy as the Fidelity Magellan mutual fund (FMAGX), will hit its three-year mark next February.

FMAG charges the same fee as FBCG. FMAG has returned 14.1% year to date as of October 3, also outperforming SPY, per Logicly.

How Semitransparent Active ETFs Avoid Front-Running

Semitransparent active ETFs disclose their portfolio holdings on a lag, which helps protect the strategy from front-running. Front-running is when managers and investors look to an active strategy and closely follow its trades to mimic the strategy’s performance.

When deciding if the semitransparent structure is suitable for an ETF, issuers may consider certain factors. These include asset class, geographic exposure, and market capitalization of the fund’s underlying investments. It also includes style and preference of the portfolio management team.

For example, FBCG discloses its portfolio holdings monthly with a 30-day lag, though Fidelity publishes a tracking basket and tracking basket weight overlap for the fund on a daily basis. The publication of a tracking basket allows market participants to price the ETF in line with the fund’s net asset value, similar to transparent ETFs. Over the past three years, funds like FBCG have been tested across a number of market environments. They have been proven to trade efficiently in the secondary market, to the benefit of end buyers and sellers.

“Not knowing what’s inside an ETF’s portfolio in real time conceivably makes it harder for traders to mimic the strategy,” said Crigger.

See more: “Play AI’s Impact in Active Disruptive ETFs FBOT, FDTX”

Active Management on the Rise in 2023

Active investing has had a strong 2023 overall. Over two-thirds of respondents to Trackinsight’s Global ETF Survey for 2023 shared that they had made some allocation to active strategies.

The biggest takeaway from the survey showed the majority of respondents plan to increase their active ETF allocation in the next two to three years.

For more news, information, and strategy, visit the ETF Investing Channel.

Fidelity Investments® is an independent company, unaffiliated with VettaFi. There is no form of legal partnership, agency affiliation, or similar relationship between VettaFi and Fidelity Investments, nor is such a relationship created or implied by the information herein. Fidelity Investments has not been involved with the preparation of the content supplied by VettaFi and does not guarantee, or assume any responsibility for, its content.

Published: October 16, 2023

Author: NICK PETERS-GOLDEN

Article originally posted at https://www.etftrends.com/etf-investing-channel/3-years-semitransparent-active-etfs-exhibit-strong-performance//